TotalEnergies Strengthens UK Renewable Portfolio with Major Acquisition of Solar and Battery Projects from Low Carbon

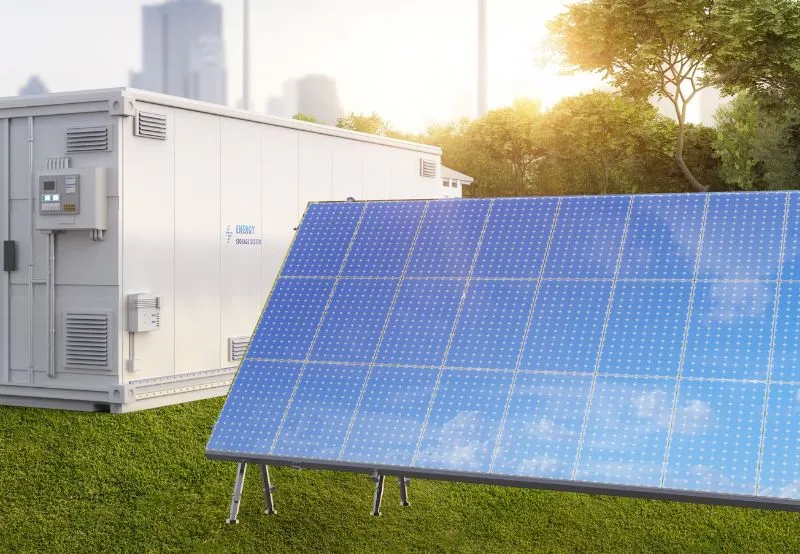

TotalEnergies (Paris: TTE), a global multi-energy company with a growing footprint in the renewables sector, has announced a significant step forward in its UK energy transition strategy. The company has completed the acquisition of a major renewable energy pipeline from Low Carbon, a prominent UK-based renewable energy investment and development firm. This transaction includes a portfolio of eight advanced-stage solar projects totaling 350 megawatts (MW) in capacity, along with two battery energy storage projects providing an additional 85 MW of flexible storage capacity.

This acquisition marks another key milestone in TotalEnergies’ strategic ambition to expand its renewable energy and storage capabilities across Europe, with a particular focus on the United Kingdom’s accelerating clean energy landscape. As global demand for renewable electricity continues to surge, driven by climate change mitigation targets, rising energy security concerns, and national energy strategies, this acquisition allows TotalEnergies to position itself as a significant player in the UK’s transition to net-zero.

Details of the Acquisition and Development Outlook

The eight solar photovoltaic (PV) projects included in the acquisition are located across southern England and are in an advanced phase of development. TotalEnergies expects these projects to become operational by 2028, contingent on final regulatory approvals, grid connections, and construction milestones. Once completed, the solar installations are projected to generate more than 350 gigawatt-hours (GWh) of clean electricity per year. That amount of energy is equivalent to the annual electricity consumption of approximately 100,000 UK households, providing a meaningful contribution toward the country’s decarbonization goals and reducing reliance on fossil fuels.

In addition to solar generation, the transaction includes two strategically positioned battery storage projects with a combined capacity of 85 MW. These battery systems will play a critical role in stabilizing the grid, balancing supply and demand, and integrating intermittent renewable sources more efficiently into the energy system. By enabling energy to be stored during periods of low demand and dispatched during peak usage, battery storage will increase the reliability and flexibility of the UK power grid.

This acquisition not only enhances TotalEnergies’ renewable electricity generation portfolio in the UK but also reflects the company’s broader strategy to integrate renewables and flexible energy solutions into a single, robust value chain. From generation and storage to trading and retail distribution, the company is aiming for a holistic approach to clean energy delivery.

Executive Commentary

Olivier Jouny, Senior Vice President for Renewables at TotalEnergies, expressed his satisfaction with the deal, noting its strategic fit with the company’s long-term renewable energy objectives in the region.

“We are very pleased with the acquisition of this pipeline from the renewable developer Low Carbon,” Jouny said. “The acquisition of these solar and battery projects located in the south of England will complement our integrated electricity portfolio in the UK, which already includes 1.1 gigawatts (GW) of gross installed offshore wind capacity, 1.3 GW of gross combined cycle gas turbine capacity, and more than 600 MW of solar projects currently under development.”

Jouny further emphasized that the transaction is consistent with TotalEnergies’ ambition to become a world-class player in the renewable electricity sector, targeting 100 GW of renewable generation capacity globally by 2030. The integration of new UK-based solar and battery projects reflects a dual commitment to sustainability and energy diversification in one of Europe’s leading energy markets.

Roy Bedlow, Chief Executive Officer and Founder of Low Carbon, also highlighted the importance of this transaction for both companies and for the UK’s clean energy future.

“We are very pleased to have finalised this agreement with TotalEnergies, who are making an impressive commitment to building renewable infrastructure,” Bedlow said. “This deal sees Low Carbon deliver one of the largest ready-to-build portfolios of solar and battery projects in the UK market. Once built, these projects will make a vital contribution to the Government’s Clean Power 2030 ambition and reinforce Low Carbon’s track record for developing renewable assets of the highest quality.”

Bedlow emphasized that the sale allows Low Carbon to redeploy capital and resources to support the continued growth of its own development pipeline, thereby accelerating the company’s mission to scale as a global independent power producer (IPP). He added that partnerships such as this are crucial for accelerating clean energy deployment at the scale and speed required to meet national and international climate targets.

Context: The UK’s Push Toward Clean Energy

The United Kingdom has set ambitious targets for the decarbonization of its electricity system, including the Government’s stated goal of achieving a net-zero electricity grid by 2035 and 95% low-carbon power by 2030. As part of this strategy, solar power is expected to play a central role, alongside wind, nuclear, and storage technologies.

Solar capacity in the UK has grown significantly over the past decade, yet experts note that further growth is required to meet the government’s clean power targets. According to the UK’s Department for Energy Security and Net Zero (DESNZ), solar generation capacity may need to quadruple by 2035 to help meet net-zero commitments. Battery energy storage is also viewed as essential, as it provides the flexibility needed to manage variable renewable generation and maintain grid reliability.

This policy backdrop makes the TotalEnergies–Low Carbon transaction particularly timely. By adding 350 MW of solar and 85 MW of storage capacity to its UK pipeline, TotalEnergies is making a clear statement of intent to become a long-term investor and operator in the country’s energy future.

TotalEnergies’ Broader Renewable Energy Strategy

Globally, TotalEnergies has committed to growing its renewable electricity capacity to 35 GW by 2025 and to 100 GW by 2030. The company is investing in a diverse range of clean technologies, including solar, wind (onshore and offshore), battery storage, and green hydrogen. These initiatives are part of the company’s broader transformation from a traditional oil and gas company into a multi-energy enterprise.

In the UK, TotalEnergies already holds a diverse energy portfolio, including:

- 1.1 GW of gross offshore wind capacity through various partnerships and joint ventures.

- 1.3 GW of gross combined cycle gas turbine (CCGT) capacity for flexible baseload generation.

- Over 600 MW of solar projects in its development pipeline, which will now expand significantly following this acquisition.

The addition of the Low Carbon pipeline significantly strengthens the company’s solar and storage profile in the country and complements its activities in wind and gas, creating a balanced and resilient energy mix.

The acquisition of these solar and battery projects positions TotalEnergies as a significant contributor to the UK’s clean energy transition. The company’s integrated approach—combining generation, storage, and grid flexibility—reflects a forward-looking strategy that aligns with evolving energy needs, regulatory frameworks, and environmental imperatives.

With the projects targeted to be operational by 2028, TotalEnergies is now in a position to influence not just the energy landscape of the next few years but the shape of the UK’s electricity system for decades to come. The focus on high-quality, advanced-stage developments will allow the company to expedite construction timelines, secure favorable power purchase agreements (PPAs), and contribute meaningfully to the UK’s clean power supply.

Meanwhile, for Low Carbon, the transaction represents both a strategic success and a springboard for future development. As the company continues to build and scale renewable energy assets across the UK and internationally, this deal provides validation of its development model and long-term vision.