FERC Grants Accelerated Final Order and Approves Construction Timeline for Glenfarne’s Texas LNG Project

The Federal Energy Regulatory Commission (FERC) has taken a significant step forward in advancing U.S. liquefied natural gas (LNG) development by re-issuing the Final Order authorizing the construction and operation of the Texas LNG project. In a move that underscores both regulatory efficiency and industry momentum, FERC not only re-affirmed its authorization but also approved the detailed construction schedule for the facility, providing clarity and certainty to the project’s stakeholders. The order, which had originally been expected later in the year, was delivered on Thursday, August 21, 2025—three months ahead of schedule.

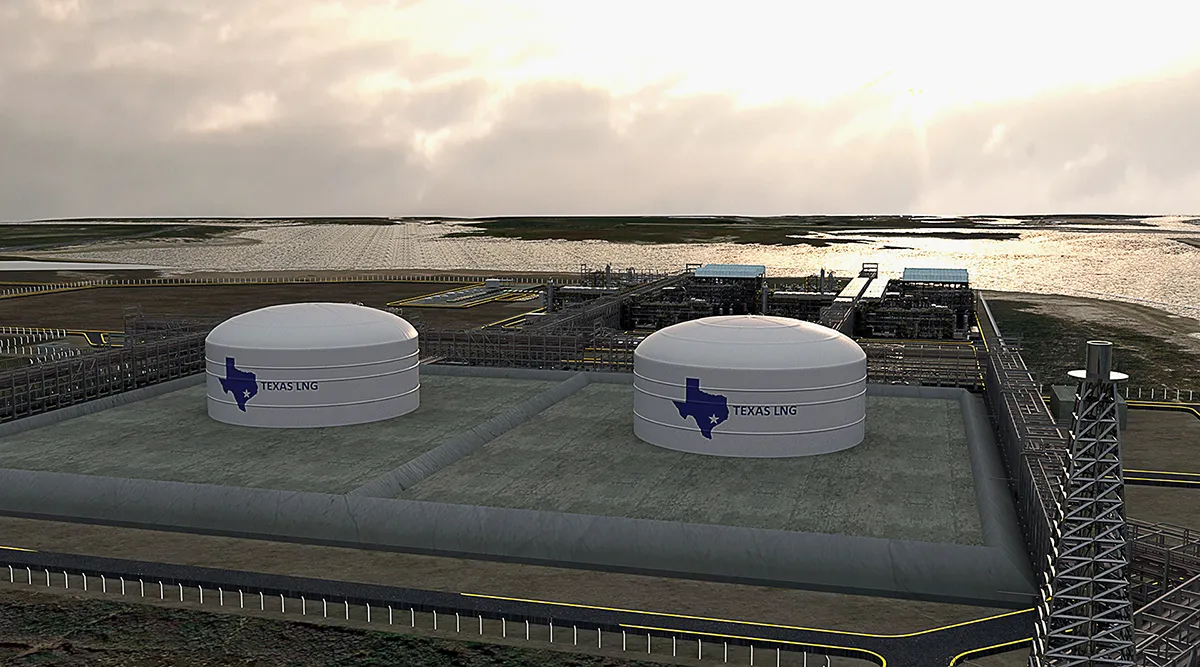

The Texas LNG facility is being developed by Texas LNG Brownsville LLC, an affiliate of the global energy and infrastructure investment firm Glenfarne Group, LLC. Strategically located in the Port of Brownsville, Texas, the project is positioned to become a major contributor to the United States’ LNG export capacity and to play a vital role in supporting both domestic energy strategy and international energy security. Glenfarne has indicated that the company is targeting a Final Investment Decision (FID) on the project by the end of this year, a milestone that would mark the official green light for full-scale execution.

With FERC’s early authorization, Glenfarne now has both the regulatory certainty and the approved construction framework needed to move rapidly toward that FID. The construction timeline approved by the Commission sets a completion date of November 2029, establishing a clear pathway for project delivery.

CEO Statement Highlights Momentum

Brendan Duval, Chief Executive Officer and Founder of Glenfarne Group, welcomed the development with optimism, emphasizing both the significance of the accelerated regulatory decision and the strategic importance of Texas LNG in the company’s broader portfolio.

“Texas LNG is rapidly advancing toward a targeted year-end Final Investment Decision, and the re-issued FERC authorization, finalized three months ahead of schedule, greatly accelerates our momentum through the second half of the year,” Duval stated. “Our world-class partners bring tremendous expertise to this project. The administration’s common-sense energy policies and the hard work of the FERC commissioners and staff, as well as the support from the Texas congressional delegation, are helping us unlock the project’s many benefits.”

Duval’s remarks highlight the combination of federal regulatory coordination, political support, and private sector execution capability that together form the foundation for Texas LNG’s progress. His reference to “world-class partners” points to the strong consortium of firms and experts backing the project—an essential factor in gaining confidence from global LNG buyers and financial institutions.

Customer Commitments and EPC Strength

A critical enabler for reaching FID is the securing of sufficient customer offtake commitments. According to Glenfarne, Texas LNG has already lined up agreements that cover volumes necessary to achieve FID. These commitments not only validate the demand outlook for the project but also provide financial certainty for lenders and investors who are evaluating participation.

On the execution front, engineering, procurement, and construction (EPC) responsibilities have been entrusted to Kiewit, a firm with extensive experience in delivering large-scale energy infrastructure projects. Kiewit is contracted under a lump-sum turnkey (LSTK) structure, which provides added assurance to Glenfarne and its partners that costs and timelines will be tightly managed. The choice of an LSTK model reflects Glenfarne’s emphasis on disciplined project delivery, reducing risks typically associated with megaproject construction.

Role in Glenfarne’s Global LNG Portfolio

The Texas LNG project is not an isolated effort. Rather, it forms part of Glenfarne’s broader, federally authorized LNG development portfolio, which collectively represents 32.8 million tonnes per annum (MTPA) of potential liquefaction capacity. Alongside Texas LNG, the company is advancing the Alaska LNG project and the Magnolia LNG project, each of which adds geographical diversity and scale to Glenfarne’s ambitions in the global LNG marketplace.

This portfolio approach positions Glenfarne as a significant player in an industry that is undergoing rapid transformation. As countries worldwide seek secure, affordable, and cleaner energy solutions, LNG is increasingly recognized as a crucial bridge fuel in the transition to lower-carbon energy systems. Glenfarne’s projects, spread across key U.S. locations, are designed to meet rising global demand while leveraging America’s abundant natural gas resources.

Importance of FERC’s Early Action

The accelerated issuance of FERC’s Final Order is notable for several reasons. First, it provides a rare example of regulatory processes working ahead of schedule, which is particularly valuable for capital-intensive projects that rely on long lead times for construction and financing. Second, it reflects strong alignment between federal energy policy goals and private sector initiatives aimed at boosting LNG exports. Finally, it enhances investor confidence by removing uncertainty about regulatory timelines.

For Glenfarne, the early order is more than just an administrative milestone—it directly impacts the project’s ability to maintain momentum. Every month gained on the regulatory calendar strengthens the company’s negotiating position with offtakers, investors, and EPC contractors, while also improving the probability of meeting its self-imposed year-end FID target.

Strategic and Economic Implications

The Texas LNG project carries significant implications beyond Glenfarne and its partners. For the State of Texas, it represents a major investment in the Port of Brownsville region, promising job creation, tax revenues, and supply chain activity. During the multi-year construction phase, the project is expected to generate thousands of direct and indirect jobs, while long-term operations will support hundreds of permanent positions.

From a national perspective, the project contributes to the United States’ status as a leading LNG exporter. In recent years, U.S. LNG has become a critical resource for allies in Europe and Asia, particularly in the context of energy security concerns and efforts to diversify away from Russian gas. Texas LNG’s eventual completion would add meaningful capacity to U.S. export volumes, reinforcing the country’s role in stabilizing global energy markets.

Internationally, Texas LNG also highlights the continuing attractiveness of U.S. LNG supply. Buyers in Asia, Europe, and Latin America have increasingly sought long-term contracts with American exporters due to the perceived reliability of the U.S. regulatory framework, the transparency of its market system, and the depth of its natural gas reserves. Glenfarne’s ability to secure offtake agreements at this stage of development reflects those dynamics.